Recent Posts

Despite the impending economic storm and business closures, rapidly expanding Australian-owned Bullion Dealer opens operations in Melbourne’s CBD

Posted on

During the COVID-19 pandemic and post-pandemic, Melbourne’s CBD sadly witnessed many businesses closing their doors. However, one of the major growth industries through the pandemic, as has been for the past few decades, is the precious metals industry.

Australian privately-owned bullion dealer As

Good as Gold Australia has determined that the continued and unprecedented

prevailing economic uncertainty in the world will lead to the greatest gold and

silver bull run in history.

“Under these circumstances, the lure to establish ourselves further and

increase our exposure in Australia’s major business hub was too overwhelming to

be ignored.

Hence, we are delighted to announce the opening of our new premises in the heart of Melbourne’s CBD on Monday 14 November 2022,” said CEO Darryl Panes.

It is globally understood that by purchasing precious metals, the client has a lifelong opportunity of protecting their financial future during the forthcoming economic storm and for years to come.

According to the globally recognised leading expert on monetary history, economics, investing, and precious metals, author of the ‘Guide to Investing in Gold & Silver’, Michael Maloney confirms that gold and silver have served as the “ultimate safe-haven investment in times of financial chaos throughout history, and today is no exception.”

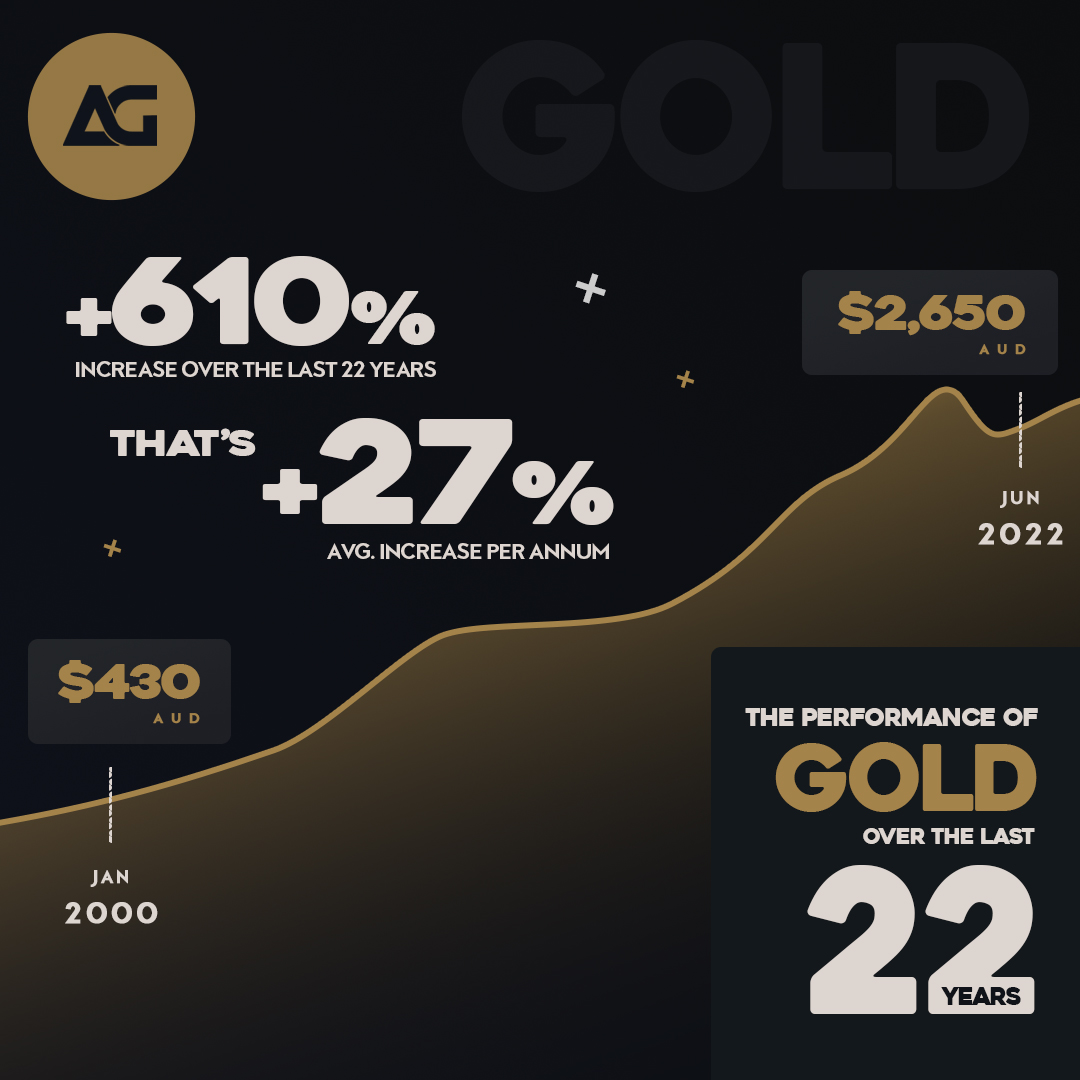

Gold has always been and remains the ultimate safe-haven investment. Gold is currently trading at $2,644 AUD and has increased in value by +610% over the last 22 years (refer to image no.1).

In today’s times of economic uncertainty, As Good As Gold Australia is reporting a steady client demand to purchase both gold and silver.

“Clients are choosing to buy bullion, which unlike

fiat currencies being subject to overarching government policies and

intervention, cannot be debased.

Bullion is in physical form and has natural value world-wide - it is a highly

liquid asset that provides investment portfolio diversification,” said Darryl

Panes.

Performance of gold over the last 22 years

The current official cash rate as determined

by the Reserve Bank of Australia (RBA) is 2.85%.

The next RBA Board meeting and official cash rate announcement will be on the 6th

of December 2022 which means many Australians are holding their breath to work

out how much extra dollars will be needed to continue their mortgage repayments

and to how to navigate the increasing cost of living.

The current market volatility is expected to push the price of gold and silver much higher now and in 2023 - smart investors are continuing to build their reserves of gold and silver as a result.

Lynette Zang, Chief Market Analyst @ITMTrading and mentor to As Good As Gold Australia recently commented that gold is the only financial asset that runs no counterparty risk.

Gold continues to be considered as one of the most powerful assets to own and anyone can purchase bullion.

TOP 5 Reasons to own Gold

- Gold is the only money that has maintained its value for over 5,000 years.

- Gold is a completely private, anonymous and extremely portable wealth preservation instrument.

- There is only enough investment-grade gold available on Earth for every living person to own less than one ounce, making this precious metal highly sought-after.

- Throughout human history, gold has been revalued to account for all excess currency in circulation. Today, to account for all the US dollars printed by the Federal Reserve, gold would have to be revalued at a minimum of AUD$15,000 per ounce.

- In times of crisis, gold is the safest form of insurance that also has the greatest potential to protect your wealth. Studies over the past five decades have confirmed that a balanced, diversified portfolio holding gold performs better than those without gold.

TOP 5 Reasons to own Silver

- The world has used up as much silver as has ever been mined, and today's silver inventories are at very low levels, yet silver is extremely affordable. This may not be the case for very much longer.

- Currently as an investment, silver could even be the better option in the precious metals space because it is in incredibly high demand, and yet still so undervalued.

- Apart from being physical money, silver has thousands of essential industrial uses - silver is the most electrically conductive, thermally conductive, and reflective metal on the planet.

- Silver is a 'miracle metal', second only to oil, as the world's most useful commodity.

- Over the last 5000 years, there have been approximately 3,800 fiat currencies that have become worthless - no fiat currency has lasted forever. Eventually, they all fail, and today fiat currencies are all made of paper, backed by nothing.

AUD

AUD

Loading... Please wait...

Loading... Please wait...