Recent Posts

RBA Trapped in a Never-Ending Dead-End Debt Bubble

Posted by on

RBA Trapped in a Never-Ending Dead-End Debt Bubble

As Australia grapples with the ongoing COVID-19 pandemic[1], important macroeconomic developments continue to unfold which, over the medium term, are of more significance than the current COVID-19 pandemic.

These developments centre around Australia’s and the world’s largest debt bubble on record, which shows no sign of resolution.

In the past week, the board of the Reserve Bank of Australia (RBA) met to determine the future course of Australia’s monetary policy and while symbolic cosmetic changes where offered, these changes were negligible in both:

- influencing immediate-term economic conditions; and

- addressing Australia’s chronic macroeconomic structural imbalances.

Given the scale of Australia’s debt mountain, the RBA has trapped itself in a catch-22 with its monetary policy now, in effect, having only one mission – to prevent the collapse of Australia’s debt bubble, which can only be achieved through ever-more physical and/or digital money printing, hence ongoing credit creation and inflationism.

The end result being that economic living standards will continue to deteriorate in the coming years.

Economic Context of “Accelerated Stagflation”

Before analysing the meeting that took place at the RBA – and commentary that ensued - it is important to establish the broader economic context in which that meeting took place.

As noted in the June 2020 article, “Can Central Banks save the largest debt bubble in world history”[2], the unprecedented rollout of massive economic stimulus packages across the world in 2020 was done primarily as an attempt to save the largest global debt bubble in history from collapsing. Starving off such a bubble collapse would thus prevent (or postpone) a deep deflationary depression, consistent with the writings of American economist Harry Dent.

The conclusion of this article was that the economic phenomena of stagflation would be the likely resultant outcome in the short to medium-term.

This analysis was followed up by Adams and North who in November 2020 released the episode entitled “Australia’s economic emperor embraces fanatical extremism”[3], on their YouTube Channel “In the Interests of the People”. This episode documented the policy desperation of the RBA Board when it announced further extraordinary monetary stimulus measures beyond its March 2020 package at its November 2020 meeting.

Adams and North noted that the RBA had taken monetary policy beyond the point of no return in terms of pre-pandemic policy normalisation given that such normalisation would lead to a unsustainable rise in the systemic risk to Australia’s banking and financial system given the scale of Australia’s debt burden, especially household debt.

This analysis was followed up in February 2021, when Adams and North documented in the episode “Australians are overdosing on debt again”[4], that the combination of extraordinary fiscal and monetary policies, coupled with mainstream media propaganda, was resulting in a rapid new accumulation of household debt by some Australians, especially given the reinvigorated demand for houses.

These domestic factors coupled with the initial set of economic policies of the Biden Administration, led to Adams forecasting in February 2021 via the article “The Biden Administration will Accelerate Stagflation” [5] an acceleration of the stagflation process in 2021 across the world which commenced in 2020.

Accelerated stagflation means that rising rates of inflation are coupled with weak economic growth and/or relatively higher (or rising) unemployment and underemployment, typically combined with so many that are unable to generate sufficient disposable income that offsets rising prices and living/business expenses.

This forecast was followed-up via the June 2021 article entitled, “Accelerated Stagflation is now in full swing”[6], which documented evidence of accelerating stagflation, demonstrating the accuracy of Adams’ February 2021 economic forecast.

Current Debt Bubble Dimensions

Importantly, while stagflation has manifested and accelerated across the world in the past year, so has the growth in Australian and global debt. That is, the very thing which policy makers, even up to the pandemic, sought to protect from collapse has become ever larger and risker via the unprecedented economic stimulus policies.

According to the Institute for International Finance global debt rose to $US 289 trillion by March 2021 or 360% of global gross domestic product (GDP) – the largest global debt bubble in both in absolute and relative (to nominal GDP) terms in recorded economic history.

In terms of Australian debt:

- household debt rose to $AUD 2.58 trillion or 129.4% of Australian GDP for March 2021 (second highest in the world behind Switzerland as a percentage of GDP)[7];

- net foreign debt remained near its peak (of March 2020) at $AUD 1.13 trillion (or 57.2% of GDP) as of March 2021[8]; and

- gross public sector debt across Australia’s nine governments (i.e., Federal, State and Territory) as measured by ‘total non-financial public sector’ is projected to balloon by an extra $AUD 974.74 billion from July 2019 (pre‑COVID‑19 pandemic) through to June 2024, taking it to $AUD 1.780 trillion.

These figures suggest that Australia has:

- the largest household debt bubble in its national history;

- a net foreign debt bubble, which according to Brain and Manning (2017)[9], is sizeable enough to potentially trigger either a currency or balance of payments crisis if Australia’s foreign creditors were to lose confidence in Australia’s capacity to meet its international obligations; and

- an emerging public sector debt bubble given the projected scale of increased public sector debt over the forward estimates which can only be financed through ultra-low interest rates and extraordinary bond market interventions by the RBA.

Importantly, the majority of Australia’s nine governments do not have any plans to return to sustainable and recurring budget surpluses over the forward estimates.

Background Context to RBA July 2021 Meeting

Given the macroeconomic context illustrated above, speculation has increased for months, particularly in financial markets, that the major central banks around the world will begin to taper their economic stimulus programs, especially in light of recent decisions by the central banks of Russia and Brazil to raise rates to tackle surging inflation.

Such speculation has been rampant in Australia for weeks especially among bank economists and the Australian Financial Review that the RBA would follow suit. Such speculation was fuelled by the lower-than-expected rate of unemployment for May 2021 as announced by the Australian Bureau of Statistics[10][11].

Bank economists such as CBA Chief Economist Gareth Aird went in late June 2021 predicting that official interest rates in Australia would start to rise at the end of 2022 whereas Westpac Chief Economist Bill Evans publicly predicted that this would occur in the March quarter of 2023[12].

Evans went further to forecast that the official cash rate would peak at 1.25% in 2024, taking household debt servicing levels back to early 2020 (i.e., pre-COVID-19 pandemic) debt servicing levels.

RBA Board July 2021 Policy Announcement

Given the backdrop, the RBA Board made a number of important policy pronouncements at their 6 July 2021 meeting including:

- 1.keeping the official cash rate at 0.1% and the interest rate payable to exchange settlement accounts (i.e., commercial bank reserves held at the RBA) at 0%;

- 2.extending government bond purchases (i.e., the third tranche of quantitative easing (QE)) at a rate of $AUD 4 billion per week from September 2021 through to November 2021 (at a split of 80% Australian Govt and 20% State/Territory Govt bonds) resulting in the RBA owning an expected $AUD 237 billion of domestic government bonds by November 2021 (30% of total Australian Government and 15% of state/territory government bonds on issue respectively[13]);

- 3.keeping its commitment to Yield Curve Control (YCC) for the April 2024 Australian Government bond at 0.1% and not extending YCC to the November 2024 Australian Government bond; and

- 4.no extension of the Term Funding Facility – which, by June 2021, had been subscribed to the tune of $AUD 188 billion over 3 years to mid-2024 at 0.1%.

These policy pronouncements were also accompanied by a number of material statements by RBA Governor Philip Lowe at his official press conference as well as his subsequent speech to the Economics Society of Australia, Queensland Branch, on 8 July 2021.

These statements included:

Yield Curve Control

- the YCC interest rate and the official cash rate come as a package and thus will be set at the same rate.

Quantitative Easing

- future decisions regarding the RBA’s bond purchasing program (i.e., QE) are dependent on:

- othe economic effectiveness of its existing bond purchases;

- oactions of other international central banks; and

- oAustralia’s progress towards full employment.

- the effectiveness of the RBA’s QE program on economic activity is not dependent on the flow of new bond purchases but rather on the overall stock of government bonds acquired by the RBA.

- there is no locked-in path for the RBA’s QE program and may be scaled up to a higher rate of bond purchases if required.

Official Cash Rate

- the RBA’s expectation is that its official cash rate would unlikely increase until 2024 and would require the cessation of QE first and for inflation, as measured by the consumer price index (CPI) to be comfortably between the 2% - 3% band for several quarters.

- that for the CPI to increase and remain above an annualised rate of 2%, wages growth would need to rise above 3% - even though inflation (as acknowledged by the RBA) can be generated from outside the Australian labour market.

Full Employment

- that the RBA estimated full employment to be approximately 4% meaning that, for wages growth and price inflation to exceed stated benchmarks, unemployment would need to fall well below 4%.

- that, in the interim, the closure of Australia’s border was contributing to lower unemployment (particularly in regional and rural Australia as well as limited labour shortages elsewhere) and sizeable wage increases – but that this phenomenon may change in 2022 as Australia’s borders are gradually re-opened.

Real Estate Prices

- monetary policy is not concerned with the stock of household debt and real estate prices – other tools such as prudential lending standards issued by the Australian Prudential Regulation Authority, are considered to have the capacity to address these issues if household credit was to grow faster than household disposable income.

Implications

Importantly, there are four major implications to draw from the RBA’s policy pronouncement.

Firstly, despite the prominent attention given by Australia’s financial market and media, the resulting net economic effects of the RBA’s announced policy adjustments have been negligible to date.

Anecdotal evidence suggests that 4 and 5-year fixed residential mortgage interest rates have started to move higher by approximately 0.3% to 0.4% per annum in anticipation of an announcement by the RBA that it will commence tapering its stimulus program. Similar anecdotal evidence suggests that 3-year fixed residential rates have commenced rising, albeit to a lesser degree.

Little evidence to date suggests that these movements in long-term fixed mortgage rates will impact household decision making – especially the decision on whether to enter into new mortgage or personal contracts to finance purchases of residential or commercial property.

Secondly, while Australia’s economic officials and market commentators have remarked that the Australian economy is demonstrating signs of robust strength and recovery, this supposed strength is only possible with the extraordinary economic stimulus still in place, and could not be sustained if macroeconomic policy settings were normalised back to their longer-term averages (especially long‑run interest rates but also to more balanced and sustainable budgets).

Thirdly, the RBA has committed itself to an ongoing aggressive QE program without a stated intention or likely schedule of shrinking its balance sheet through quantitative tightening (QT) in terms of timing or quantity.

This will provide elected officials in both the Australian Government as well as State/Territory Governments ample ability to continue running large, undisciplined fiscal deficits that are financed, at little interest cost, through RBA-monetised public sector debt.

Fourthly, at the macro ‘helicopter’ view, the RBA and, by extension, Australia’s monetary policy is completely stuck in terms of both:

- the official cash rate; and

- the scale of assets which have been accumulated by the RBA balance sheet.

To illustrate this latter point, witness Diagrams 1 and 2 below.

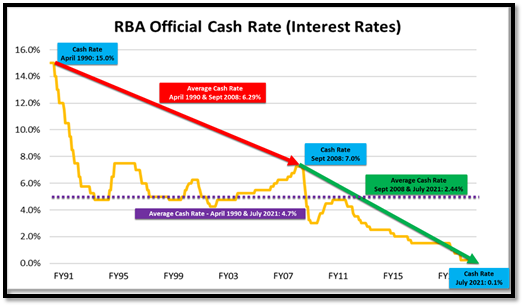

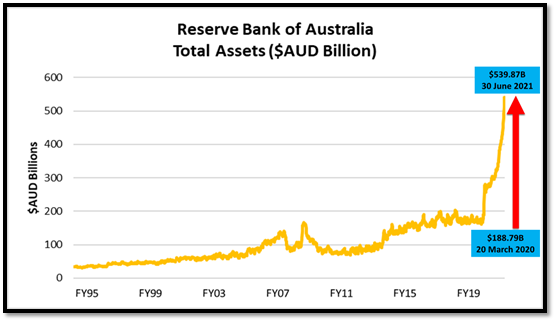

In Diagram 1, Australia’s official cash rate has, from April 1990 to July 2021, been reduced from 15% to just 0.1%, with the average cash rate over this period being 4.7%. Moreover, in Diagram 2, the balance sheet of the RBA in terms of assets has dramatically grown from $AUD 188.79 billion in March 2020 (at the commencement of the COVID-19 pandemic) through to $AUD 539.87 billion as of 30 June 2021.

Diagram 1: Australia’s Official Cash Rate

Diagram 2: Total Assets of the Reserve Bank of Australia

Given the scale of Australia’s debt bubbles (as detailed above) and structural imbalances in resource allocation (especially the quantum of labour and capital being allocated to residential and commercial real estate including via the construction sector) these phenomena cannot be materially reversed either through:

- raising the RBA’s official cash rate; or

- a sustained program of QT which would shrink the size of the RBA’s balance sheet.

To do so would ultimately increase the interest servicing costs on existing household and commercial debt and lead to higher incidences of:

- financial distress (especially mortgage stress);

- repayment delinquencies; and

- debt defaults.

Moreover, if these debt defaults were to rise to a level of critical mass, then macroeconomic systemic risk would subsequently rise to a point that would threaten the stability of Australia’s financial system.

Importantly, Australia’s banks are particularly vulnerable to this risk given that their exposure to residential mortgages as a percentage of total loans issued is well over 60%, which is approximately 1.5 times more than their international counterparts.

Thus, if such systemic risk were to be realised, this would:

- place the Australian banking sector at great risk of collapse;

- potentially trigger the largest economic depression in Australian history beyond the 17% collapse in GDP over 24 months experienced during the 1892-93 Australian economic depression;

- potentially result in either a partial or full default of Australia’s foreign debt obligations; and

- potentially trigger panic and contagion across the global financial system, leading to a potential full-scale international financial meltdown.

In the instance that Australia was not be able to meet its foreign debt obligations, not only would this result in disastrous economic consequences for the Australian economy, but would likely result in adverse geo-political consequences, especially in the realm of:

- trade;

- immigration;

- foreign investment; and

- potentially foreign diplomatic and military assistance.

Thus, given the scale of the potential downside economic, political and geo-political effects consequences that would result from economic policy normalisation, the RBA and all levels of Australia’s governments have little option but to deploy fiscal and monetary policy to ensure that Australia’s debt bubbles remain intact, should they wish to remain as Australia’s ruling political and economic establishment.

Conclusion

Governments and central banks around the globe are attempting to stop the biggest debt bubble in world economic history does not implode. Joined in this effort is Australia, its national, state and territory governments as well as its central bank, the RBA.

Moreover, given the scale of Australia’s household debt bubble (which is the second largest in the world relative to GDP), Australia’s commercial banks in particular are perhaps more vulnerable than any of their international counterparts.

Economic policy normalisation (i.e., returning interest rates and budget balances to more normal and sustainable levels) that hopes to reduce the size of Australia’s debt bubbles to more sustainable levels is almost impossible and thus the RBA and Australia’s monetary policy are trapped in a debt bubble which they cannot get out of.

Whatever adjustments to Australia’s macroeconomic policy mix, especially monetary policy, that policy makers will attempt to make in the future will likely be only symbolic and tokenistic at best.

For Australia’s ruling establishment, there is no acceptable alternative policy scenario that can resolve the stark mathematical reality facing the Australian economy.

Given this, accelerated stagflation , and potentially hyper-stagflationism, appears to be the inevitable economic nightmare facing the Australian people.

John Adams is the Chief Economist for As Good As Gold Australia

[1] This includes the fallout resulting from the risk mitigation strategies of lockdowns and the vaccine rollout.

[2] https://www.adamseconomics.com/post/can-central-banks-save-the-largest-debt-bubble-in-world-history

[3]https://www.youtube.com/watch?v=6n7HZGdVEUY

[4]https://www.youtube.com/watch?v=QyRwXL8pRWQ

[5]https://www.adamseconomics.com/post/the-biden-administration-will-accelerate-stagflation

[6]https://www.adamseconomics.com/post/accelerated-stagflation-now-in-full-swing

[7]https://www.businessinsider.com.au/australian-households-mortgage-debt-oecd-2021-6

[8] https://www.abs.gov.au/statistics/economy/international-trade/balance-payments-and-international-investment-position-australia/mar-2021/530202.xls

[9] Brain and Manning (2017), “Credit Code Red”, Scribe Publications, Melbourne, Australia.

[10]https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release

[11] Note, this contrasts with private sector statistical providers, such as Roy Morgan, who’s recently published statistical series is in stark contrast suggesting rising unemployment in Australia.

[12]https://www.afr.com/policy/economy/cba-calls-interest-rate-hike-in-late-2022-20210623-p583g9

[13] Note that the 1st QE program was announced in November 2020 to the tune of $AUD 100 billion which was primarily focused on purchasing 5 and 10-year government bonds through to April 2021. The 2nd QE program was announced in February 2021 which would see a further $AUD 100 billion of government bonds being purchased through to September 2021 at a rate of $AUD 5 billion per week.

AUD

AUD

Loading... Please wait...

Loading... Please wait...