Recent Posts

The Fallacy of the Van Metre QE Deflationary Thesis

Posted by on

The Fallacy of the Van Metre QE Deflationary Thesis

As the fallout from COVID-19 and the lockdown continues to play out around the world, the great debate among economists over whether the global economy is experiencing deflation or inflation continues to rage on.

In recent months, a set of finance professionals have taken to the internet to add their voice to this debate by making stunning claims about the monetary system and the actions of central banks.

Among these claims is that quantitative easing (QE), which is initiated and conducted by central banks, is deflationary, not inflationary as is the commonly held understanding of many in the international economics and financial community.

This claim, which has been made popular by YouTube economic commentator Steve Van Metre[1] has gained traction not only on his own online platforms, but also on a wide variety of other YouTube channel platforms such as:

- Real Vision Finance;

- Walk the World (Martin North);

- George Gammon; and

- Palisade Radio

who have enthusiastically promoted this and other extraordinary economic and financial musings of Van Metre.

The Van Metre QE Thesis

In a high-profile discussion broadcasted on Real Vision Finance on 23 September 2020 between Brent Johnson of Santiago Capital and Steve Van Metre[2] (who both agreed in this discussion that QE is deflationary), Johnson and Van Metre made the following claims with regards to QE and deflation with respect to the United States:

- when the US Federal Reserve engages in QE, the central bank buys US Treasuries from the reserves of large commercial banks (typically US treasuries with an average maturity of 7 years[3]) which operate in the United States and which have reserve accounts with the US Federal Reserve;

- the purchased US Treasuries are added to the balance sheet holdings of the US Federal Reserve;

- the US Federal Reserve then credits the reserve account of the commercial banks for the consideration of the US treasuries which the US Federal Reserved purchased;

- the commercial banks are unable to access or use the credited money in their reserve accounts for either operational purposes such as issue new loans; purchasing additional financial assets (such as US treasuries); pay federal or state US taxes or to engage in financial speculation;

- this in effect means, as directly articulated by Van Metre, that the US Federal Reserve has acquired US treasuries “without actually paying for them”;

- thus, with fewer US treasuries in the secondary market or no injection of capital from the US Federal Reserve given commercial banks are unable to access capital from their reserve accounts there is less liquidity within the US financial system;

- the lower level of liquidity in the US financial system means that the US economy is experiencing ‘deflation’; and

- commercial banks obtain capital to acquire newly issued US treasuries to replace the treasuries sold to the US Federal Reserve through the extension of private credit and normal commercial banking operations.

In addition, Van Metre, in other interviews, has made the claim that the QE process in the United States is in effect swapping of reserve assets between the US Federal Reserve and the Commercial Banks[4] (shorthand referred to by Van Metre as ‘asset swapping’).

Alternatively, during the 23 September 2020 Van Metre-Johnson conversation, both Van Metre and Johnson agreed that if the commercial banks were able to recycle capital held in their reserve accounts back into the US economy, then this would be inflationary[5].

Implications of the Van Metre Thesis

The implications of the Van Metre thesis are profound.

In an economy that carries large levels of debt (whether the economy is the United States or Australia) and no matter whether this debt is concentrated in the household, corporate or government sector, a deflationary draining of liquidity from the banking/financial system through QE (assuming the Van Metre thesis is true) carries significant and dire implications pointing to an ultimate banking crisis when the banking system runs short of capital to remain solvent.

The collapse of Lehman Brothers on 15 September 2008 which triggered the Global Financial Crisis (GFC) is only one historical example of a major bank or financial institution that collapsed from insufficient liquid capital needed to meet obligations.

If a banking crisis were to eventuate, this would have significant economic ramifications including:

- collapsing asset prices – whether they be of real estate, shares, commodities, low credit quality corporate and government bonds; etc

- triggering mass corporate bankruptcies and unemployment which in turn results in significant mortgage and other household debt defaults; and

- a sharp fall in economic activity resulting in a deep economic recession if not an economic depression.

Given the catastrophic economic and social outcomes that a banking crisis, in the current context of the largest debt bubble in world economic history, would produce, it is odd that economic policy makers would deliberately pursue a policy path that would induce a banking crisis assuming the Van Metre thesis is correct.

On this point, Van Metre in his Real Vision Finance interview discussion with Johnson claims that the US Federal Reserve:

- “I am not sure they realised this completely” (see at the 14:40 mark);

- is draining liquidity from the financial system despite statements from Chairman Jerome Powell that the central bank is injecting liquidity into the financial system and that this contradiction is in fact a psychological bluffing operation to induce Americans to engage in greater amounts of consumption (see at the 18:18 mark).

These assertions are both wild and extraordinary and have not been supported through verifiable evidence.

Moreover, and importantly, whether in the Real Vision Finance interview or in other interviews in which Van Metre articulates his QE thesis, Van Metre has failed to provide any documentary or statistical evidence that:

- proves that US commercial banks are unable to draw down the capital from their reserve accounts held at the US Federal Reserve; or

- demonstrates that the intent of policy makers is to induce a banking crisis.

Why hasn’t a banking crisis already happened?

In the aftermath of the GFC when a banking crisis did actually occur in 2008, sovereign governments and central banks (such as the US Federal Reserve) sought to stabilise the financial system by:

- stripping banks of toxic assets (i.e. primarily sub-prime mortgages);

- recapitalising banks and other financial institutions; and

- providing sufficient liquidity to global financial markets that prevented further defaults by financial institutions and large corporations and which allowed financial markets to resume normal trading and functionality.

In the aftermath of the GFC, the US Federal Reserve under the Chairmanship of Ben Bernanke initiated 3 rounds of QE from 2008 to 2014.

If the Van Metre QE thesis is correct that QE drains liquidity from financial markets, then the question must be asked why didn’t the three rounds of QE by the US Federal Reserve from 2008 to 2014 trigger a second banking crisis given that the quantum of QE during these 3 rounds reached in the trillions of dollars?

Perhaps even more profound is why hasn’t QE triggered a banking crisis in Japan given that the Bank of Japan has engaged in QE operations for longer than the US Federal Reserve and to a significant quantum scale.

These questions are something which Van Metre has failed to explain to date.

The Van Metre QE Thesis is False

Given the profound implications of the Van Metre QE thesis and given that this thesis has reached a wide global audience, (including in Australia particularly given his multiple appearances on Martin North’s ‘Walk the World’ YouTube channel) it is worth examining whether sufficient evidence exists that proves whether the thesis is true or not.

This is especially so given that:

- Van Metre’s appearances (and direct follow-up correspondence) have led to several Australians accepting QE is deflationary in both the US and Australian context without any research, critical assessment or verification[6][7]; and

- Van Metre has received significant praise from economic and financial commentators such as Brent Johnson and Martin North who, in the latter case, publicly stated in his 4 August 2020 YouTube interview that Van Metre was “on the ball” and “absolutely on the nail”.

In a series of e-mail exchanges between the Reserve Bank of Australia (RBA) and myself, sufficient evidence has been uncovered to prove that the Van Metre thesis is false in the Australian context and that QE operations in Australia since the onset of the COVID-19 pandemic have actually been inflationary, not deflationary.

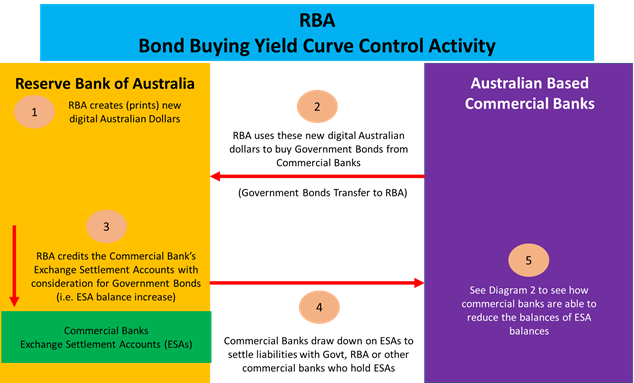

At the heart of the RBA - Adams dialogue is how does QE work in Australia and whether the liquidity which is created by the RBA can be recycled back into the Australian economy via the commercial banking system.

This evidence will be outlined below.

Mechanics of the RBA Bond Buying Operations

At the time that the RBA’s bond buying program was announced on 16 March 2020[8], attempts were made by various media outlets and professional economic and financial organisations to explain how this program would work at an operational and technical level.

On 23 March 2020, the Economics Correspondent for the Australian Financial Review (AFR), Matthew Cranston, described the RBA’s bond buying program in an article entitled “QE: What it means for Australia” as follows[9]:

"Instead of paying for these bonds with existing money from the Reserve Bank's $200 billion balance sheet, the central bank will just enter into its electronic ledger system that $5 billion of brand-new money suddenly exists in a bunch of RBA exchange settlement accounts held by commercial banks whose customers just sold those bonds. Those customers can be everyone from banks to superannuation funds."

On 17 September 2020, I wrote to the RBA asking whether the AFR’s description was correct and whether the RBA has placed any restrictions on what the commercial banks may do with the capital that has been credited to their ‘exchange settlement accounts’.

On 18 September 2020, the following official response was received from the RBA:

“In terms of how we pay for the bonds, The AFR is more or less correct. When we buy a bond off a bank, we pay that bank by crediting it’s exchange settlement account with new funds (commercial banks hold accounts with the RBA – called ‘exchange settlement accounts’ – which they use to make payments to each other and to the RBA/government). These new exchange settlement account funds are a liability of the Reserve Bank. From the commercial bank’s perspective, they sell one asset (the bond) and get another asset (new funds in their exchange settlement account). From the Reserve Bank’s perspective, we gain an asset (the bond), and also create an offsetting liability (the new exchange settlement account funds).

“To answer your other questions, the money in those accounts belongs to the commercial banks, just like the money in your bank account belongs to you. So yes, they can use that money to make payments. In general, the only restriction is that they can’t overdraw their account and go negative. They can also only transfer exchange settlement account funds to other entities with an exchange settlement account (being, generally speaking, banks) and/or to the RBA/government.”

To visualise the description provided by the RBA, a flow chart is presented via Diagram 1.

Diagram 1: Money Flows to and from the RBA’s Exchange Settlement Accounts

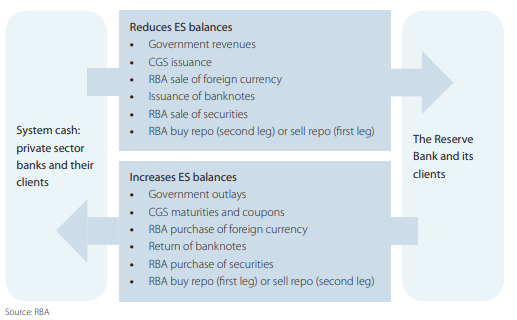

To test the veracity of the Van Metre QE thesis of whether liquidity is being added or withdrawn from the financial system and economy, it is important to explore the question as to how commercial banks operating in Australia, and who have ESAs, utilise their credited capital sitting in their ESAs.

These options were elaborated by the RBA via a publication of their quarterly bulletin series in December 2010, entitled: “Domestic Liquidity Operations and Liquidity Forecasting”[10]. Diagram 2 (shown below), which has been extracted from the 2010 RBA publication, illustrates the circumstances of how capital can either be credited to or debited from the ESAs.

Diagram 2: Money Flows to and from the RBA’s Exchange Settlement Accounts

Thus, the official correspondence from the RBA coupled with its 2010 publication demonstrates that the Van Metre thesis, at least in the Australian context, is false given that capital credited to the ESAs can be injected into the Australian economy by the commercial bank account holder through a variety of channels.

Nevertheless, even with this evidence, it is important to examine what has transpired during the course of 2020 given that this year is the first year in which the RBA officially initiated its bond buying program for the purpose of suppressing interest rates that stimulate economic activity.

The RBA’s 2020 QE Operations

With the onset of COVID-19 in early 2020 and the implementation of a lockdown of the Australian economy by Australia’s National Cabinet (a make shift decision making body comprising of the Prime Minister and the various State Premiers and Territory Chief Ministers), the RBA launched an unprecedented monetary policy stimulus program including the purchasing of Commonwealth and State/Territory bonds with a target of 0.25% of bonds of 3-year maturity.

Officially, the RBA claims that its bond buying program is not QE, but in effect yield curve control (YCC)[11]. This was acknowledged in official e-mail correspondence mail from the RBA to myself on 18 September 2020, in which the RBA stated:

“As an aside we generally do not refer to the RBA’s bond purchases as ‘quantitative easing’. Quantitative easing usually refers to a central bank committing to buy a set quantity of bonds, no matter their price. This is not what the RBA has done or is doing. Rather, the RBA has bought bonds/conducted asset purchases to hit our 3-year Australian Government bond yield target of around 0.25 per cent and address bond market dysfunctions which existed at the start of the crisis.”

For the purposes of examining the claims of Van Metre, any distinction between QE and YCC on behalf of the RBA is immaterial.

Nevertheless, in assessing the economic impact of the RBA’s 2020 bond buying program, it is important that we note the recent speech on Australian monetary policy delivered by RBA Deputy Governor Guy Debelle on 22 September 2020[12], in which Debelle stated the following:

“ES balances have risen to around $50 billion and were as high as $90 billion in recent months; considerably larger than the $2–3 billion that prevailed before the pandemic. The low level of the cash rate is anchored by the interest rate paid on banks’ ES balances at the RBA, which is set at 10 basis points.”

This statement from Debelle is material in assessing the Van Metre QE thesis given that the RBA has not reduced its holdings of Commonwealth or State/Territory government bonds since the commencement of the bond buying program in March 2020.

What happened to the $AUD 40 Billion in drawn down ESA balances?

Thus, the critical question to ask as to whether the RBA’s bond buying program is either inflationary or deflationary is what happened to the $AUD 40 billion which was drained from the ESAs during the course of 2020.

This question was put by myself to the RBA via an e-mail on 24 September 2020 and the following response from the RBA was received on 25 September 2020:

“The Reserve Bank does not track what transactions commercial banks choose to engage in with other commercial banks. The transactions that commercial banks enter into with the central bank and its clients are known to us, but are subject to confidentiality of that client’s account. Some information about deposits at the Reserve Bank is regularly published on our website. An interesting and relevant article describing liquidity in the form of exchange settlement balances, as well as the factors that influence it, can be found in the 2010 Bulletin and a recent speech by the Deputy Governor.

“It’s also worth noting that when commercial banks make payments to other private sector entities, the stock of ES balances is not changed, it is just moved from one bank to another bank. ES balances fall when the private sector transfers money to the public sector (e.g. pays tax, buys a newly issued government bond) and ES balances rise when the public sector transfers money to the private sector (e.g. the RBA buys a bond, or the government makes a payment).”

Although the RBA did not divulge the precise whereabouts of the $AUD 40 billion in drawn down capital, the response from the RBA combined with Diagram 2 (shown above) is in fact very telling.

During the course of the COVID-19 pandemic, there have been media reports of a sharp increase in the demand by commercial banks for physical bank notes (physical cash denoted in Australian dollars)[13] as confidence in the soundness of Australia’s banks was severely tested, particularly in February and March 2020 when the Australian Stock Exchange represented by the ASX200 index experienced a sharp decline in equity prices of more than 30%[14].

According to official data from the RBA, the issuance of currency (or M0) increased by $AUD 11.5 billion from $AUD 79 billion in February 2020 to $AUD 90.5 billion in August 2020[15]. Given that the collection of bank notes represents a liability to the RBA, these bank notes can be paid for by commercial banks using capital within ESAs as outlined above in Diagram 2.

Thus, the rapid issuance of physical bank notes during the course of 2020 is one of the locations where the capital leakage from ESAs went to.

While the whereabouts of the remaining capital is unknown, paying Commonwealth tax obligations and purchasing additional Commonwealth and State/Territory Governments bonds (as signalled by the RBA’s 25 September 2020 e-mail) are the likely other locations.

All in all, the withdrawal of $AUD 40 billion from ESAs represents additional liquidity to Australia’s financial markets and thus as admitted by both Van Metre and John in their Real Vision Finance interview this added liquidity is inflationary, not deflationary.

From a money supply perspective, this injected liquidity would be best captured by the RBA’s ‘broad money’ measurement of the money supply which as of August 2020 is growing at the fastest annualised rate since June 2009 at 11.5% per annum.

Conclusion

The emerging economic thesis in 2020 that QE is deflationary is quickly gaining traction across the world through a series of self-produced videos by Steve Van Metre and interviews hosted by other popular YouTube channels.

To date, neither Van Metre nor his deflationist disciples have produced any compelling documentary or statistical evidence that would substantiate these claims.

In the Australian context, the proposition that QE is deflationary is categorically false, given that the RBA has admitted in a series of e-mails that commercial banks are able to draw down on capital held in ESAs to either settle liabilities with other commercial banks, the RBA or the Australian Government.

This draw-down of liquidity from ESAs means that the overall money supply is growing as a result of the RBA’s bond buying activities (whether these activities are described as QE or YCC) which is in turn inflationary, given that more Australian dollars circulating throughout the Australian economy diminishes the purchasing power of the currency ceteris paribus.

As admitted by RBA Deputy Governor Debelle, the RBA’s bond buying activity since March 2020 has seen ESA balances swell substantially from $AUD 2 billion to $AUD 90 billion, before reducing back to $AUD 50 billion as of September 2020.

While apparent commercial‑in-confidence sensitivities prevent the RBA from fully revealing the whereabouts of the $AUD 40 billion which has been drawn down from ESAs by commercial banks, the most likely locations as to where the capital has gone are as follows:

- issuance of an additional $AUD 11.5 billion in physical bank notes,

- the payment of Commonwealth tax obligations and

- the purchase of Commonwealth and State/Territory Government bonds

are the most likely locations for where the capital has gone to.

All in all, those people who seek to obtain economic information and analysis whether from official mainstream media organisations or from the alternative media, need to ensure that claims made are robustly checked and verified before being accepted.

Otherwise, significant financial mistakes can be made when false and misleading information is accepted and acted upon in terms of capital allocation.

John Adams is the Chief Economist for As Good As Gold Australia

[1] Steve Van Metre body of economic commentator can be found at the following website: http://stevenvanmetre.com/ or via the Steve Van Metre YouTube Channel: https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw

[2] The Johnson – Van Metre Real Vision Finance YouTube interview can be found at the following link: https://www.youtube.com/watch?v=h_HCIyc6MaA&t=2609s

[3] This specific reference was made in an interview between Steve Van Metre and Martin North which was broadcasted on the Walk the World YouTube channel on 1 July 2020. This can be viewed at the following link: https://www.youtube.com/watch?v=0FVR1xfAGbY&t=414s

[4] See this claim being made in an interview between Steve Van Metre and Martin North in an interview broadcasted on 4 August 2020 at the 6:27 mark on the Walk the World YouTube channel. The interview can be viewed at the following link: https://www.youtube.com/watch?v=vj-Ib6_yWgA

[5] This claim is made at the 24:09 mark of the Johnson – Van Metre interview (see footnote 2)

[6] Importantly, in his 4 August 2020 interview with Martin North (see footnote 4), Van Metre admitted to receiving correspondence from North’s Australian audience and confirming that he provided written confirmation that QE is indeed deflationary.

[7] It is important to note that a contributing factor to this phenomenon is that hosts who interviewed Van Metre did not sufficient question or challenge his QE assertions. Nor did they request documentary evidence before broadcasting his claims on YouTube.

[8] https://www.rba.gov.au/media-releases/2020/mr-20-07.html

[9] https://www.afr.com/policy/economy/qe-what-it-means-for-australia-20200323-p54cvr

[10]https://www.rba.gov.au/publications/bulletin/2010/dec/pdf/bu-1210-5.pdf

[11] According to Investopedia:

“Yield Curve Control (YCC) involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.Advocates of yield curve control, also called YCC, argue that, as short-term interest rates approach zero, keeping longer-term rates down may become an increasingly more effective policy alternative for stimulating the economy.”

For more information: https://www.investopedia.com/what-is-yield-curve-control-4797189

[12] https://www.rba.gov.au/speeches/2020/sp-dg-2020-09-22.html

[13] https://www.afr.com/policy/economy/millions-at-a-time-rba-reveals-run-on-cash-during-panic-20200409-p54iih

[14]https://www.news.com.au/finance/markets/australian-markets/aussie-share-markets-death-spiral-to-continue-when-bell-rings/news-story/60bf6b3c57707873ec7b5705ec9bd897

[15] This data be verified by examining the RBA’s D3 – Monetary Aggregates statistical table.

NZD

NZD

Loading... Please wait...

Loading... Please wait...